Introduction

As parents, your first instinct is to protect your children—from harm, from uncertainty, and from an insecure future. One of the most powerful tools in doing so is securing the right life insurance policy. It ensures that if something happens to you, your children will be financially protected and able to continue their lives without the added burden of financial distress.

In this detailed guide, we will explore the best life insurance policies for parents, why they matter, the types available, top providers in 2025, and how to choose the most suitable plan to protect your children’s future.

Why Parents Need Life Insurance

Life insurance is more than just a financial tool—it’s an act of love and responsibility. For parents, the stakes are higher because your income likely supports:

- Daily living expenses

- Mortgage or rent

- School and college fees

- Childcare and health expenses

- Future goals (college, weddings, savings)

If you were no longer around, could your children maintain their current lifestyle? That’s the fundamental question life insurance answers.

Benefits of Life Insurance for Parents

- Income Replacement : Provides money to your spouse or children in your absence.

- Covers Debts: Helps pay off mortgage, loans, and credit card debts.

- Education Funding: Supports your children’s future education costs.

- Peace of Mind: You rest easier knowing your loved ones are protected.

- Legacy Building: Leave a tax-free inheritance or start a trust fund.

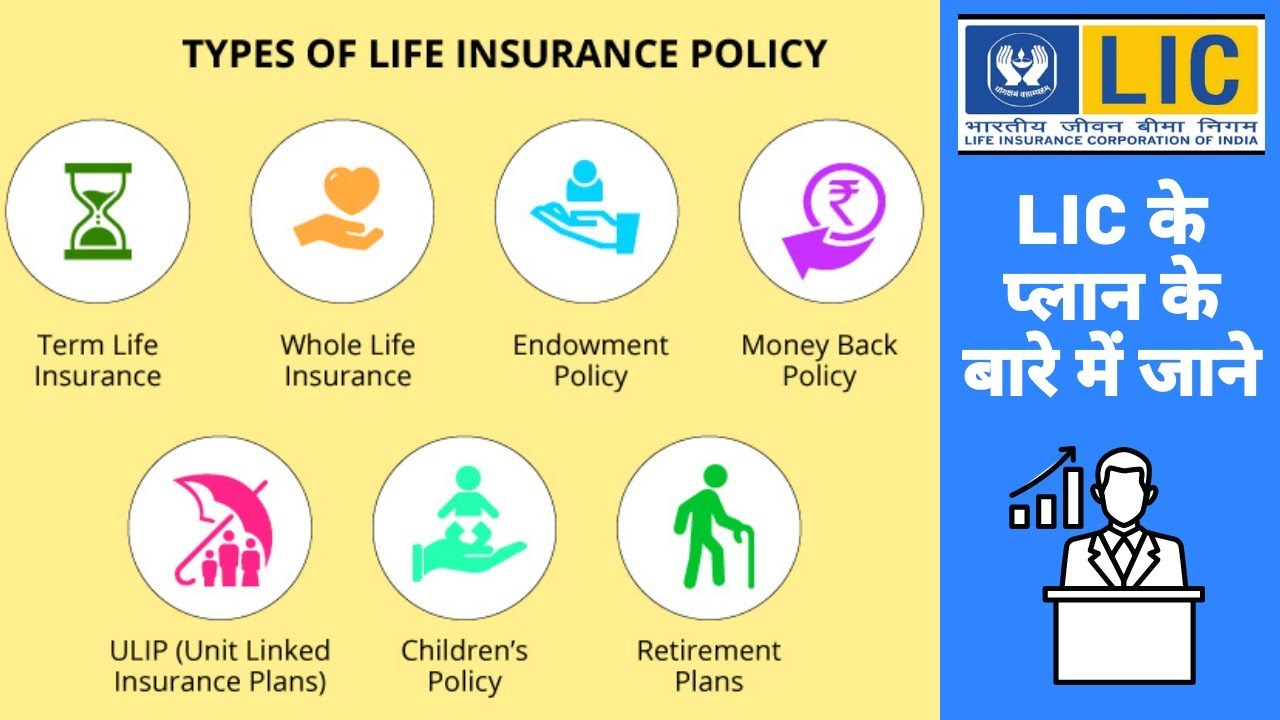

Types of Life Insurance Policies for Parents

Choosing the best policy starts with understanding your options.

1. Term Life Insurance

- Most affordable option

- Covers a specific term (10, 20, or 30 years)

- Payout only if death occurs during the term

- Ideal for parents with young children or mortgage

Example: $500,000 policy for 20 years for a healthy 35-year-old = ~$25/month.

2. Whole Life Insurance

- Permanent coverage (doesn’t expire)

- Includes cash value accumulation

- More expensive than term policies

- Good for long-term protection and wealth building

3. Universal Life Insurance

- Flexible premiums and death benefits

- Includes investment component

- Can be used to grow savings while providing coverage

4. Final Expense Insurance

- Meant for funeral and burial costs

- Coverage up to $50,000

- Best for older parents

Best Life Insurance Policies for Parents in 2025

| Insurance Company | Policy Type | Max Coverage | Term Options | Best For |

| Haven Life | Term | $3 million | 10–30 years | Young parents |

| Ethos Life | Term & Whole | $2 million | 10–30 years | Quick online process |

| Mutual of Omaha | Whole, Term, Final Expense | Varies | Lifetime/10–30 yrs | Senior parents |

| Fabric by Gerber | Term | $1.5 million | 10–20 years | New parents |

| Ladder Life | Term (scalable) | $3 million | Flexible | Growing families |

| State Farm | Whole & Term | Varies | Various | Trusted provider |

How Much Coverage Do You Need?

Use the DIME method:

- Debt: Mortgage, loans, credit cards

- Income: Multiply your annual income by years you want to provide support

- Mortgage: Balance left on your home

- Education: Future tuition fees for your children

Example:

- $200,000 Mortgage

- $50,000/year income × 15 years = $750,000

- $100,000 for college

Total = $1.05 million in coverage

How to Choose the Best Life Insurance Policy for Your Family

1. Assess Your Needs

- How many children do you have?

- What are your long-term financial goals?

- Will your spouse also be covered?

2. Decide Between Term and Whole Life

- Term = Affordable, temporary coverage

- Whole = Lifetime coverage + cash value

3. Compare Multiple Quotes

- Use websites like Policygenius, NerdWallet, or insurer websites.

- Ensure the company is A-rated or better by AM Best.

4. Consider Adding Riders

- Child Rider: Covers your children under one policy

- Waiver of Premium: Stops premiums if you become disabled

- Accidental Death Benefit: Extra payout in case of accidental death

5. Check Conversion Options

- Some term policies allow you to convert to whole life later without a medical exam.

Life Insurance for Single Parents

If you’re a single parent, life insurance becomes even more critical. Your children may rely solely on your income. Look for:

- Affordable term policies

- Quick approval (e.g., no medical exam)

- Policies with trusts or beneficiary control if children are minors

Naming a Beneficiary: What Parents Should Know

Best Options

- Spouse or co-parent

- Legal guardian

- Trust for minor children

Avoid

- Naming minor children directly (they can’t legally receive funds until 18–21)

- No beneficiary (payout goes to estate and delays access)

Tip: Set up a trust fund or appoint a custodian under the Uniform Transfers to Minors Act (UTMA).

What Happens If You Outlive a Term Life Policy?

- No payout is made.

- You can:

- Renew the policy (higher premiums)

- Convert to whole life (if option available)

- Buy a new term policy

- Renew the policy (higher premiums)

If your children are financially independent by then, you may not need a new policy.

Real-Life Scenario

Meet Raj and Anika – Parents of Two

- Ages: 38 and 36

- Kids: Ages 5 and 8

- Income: $120,000/year combined

They purchase:

- $1 million term life insurance each

- 20-year term

- Premium: $45/month (combined)

Why this works:

- Covers kids through college

- Affordable monthly payments

- Protects their mortgage and income

Common Mistakes Parents Make When Buying Life Insurance

- Underinsuring – $100K won’t cover much.

- Naming kids directly as beneficiaries

- Ignoring term limits

- Delaying purchase – Costs increase with age

- Not updating policy after major life changes

FAQs – Life Insurance for Parents

Q1: Should both parents have life insurance?

Yes. Even if one parent is a stay-at-home caregiver, their role has value and cost that needs replacing.

Q2: Can I get life insurance while pregnant?

Yes. You can apply during pregnancy, especially early stages. Some providers may rate based on gestational health.

Q3: Is a joint policy better than separate policies?

Separate policies often offer more flexibility and better individual benefits. Joint policies may save on premiums.

Q4: Can I buy life insurance for my parents?

Yes, but only with their consent. You’ll also need to prove an “insurable interest” (financial dependency).

Conclusion:

As a parent, securing a life insurance policy is one of the most loving financial decisions you can make. It offers long-term protection, covers crucial expenses, and gives your children a stable foundation—even if you’re no longer around.

Whether you choose a term life policy for its affordability or a whole life policy for lasting security, the most important step is to act now.

Start comparing, ask questions, and choose a provider that aligns with your goals—because your family’s future depends on the decisions you make today.